Choosing the Best Health Insurance Plan for Your Unique Health Needs

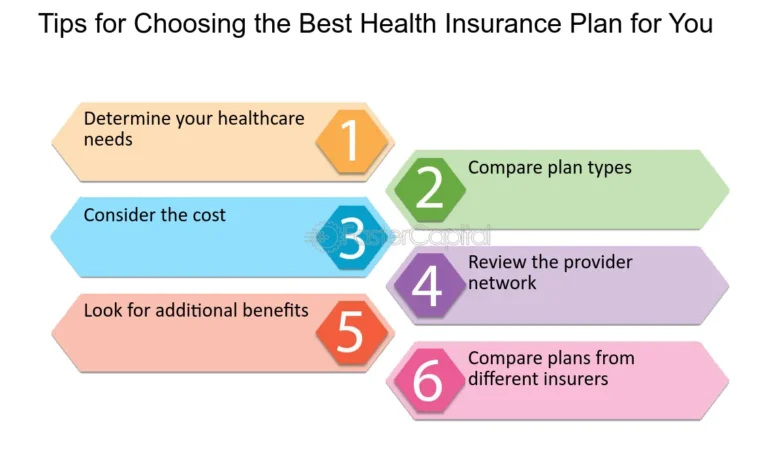

Choosing the best health insurance plan can feel overwhelming, especially when it comes to meeting your unique health needs. With so many options available, it’s important to find a plan that not only fits your budget but also provides the right coverage for your personal healthcare requirements.

Whether you need routine checkups, prescription medications, or specialized treatments, understanding how to evaluate plans will help you make a more informed decision for both your present and future health.

Know Your Health Needs

Do you regularly visit the doctor or need ongoing treatments? If you have chronic conditions or take prescription drugs, you’ll want a plan with strong coverage for doctor visits and medications. On the other hand, if you’re generally healthy and don’t require frequent medical care, a basic plan may suit your needs.

Consider your medical history and the types of services you’ll need over the next year. This can help you estimate your healthcare expenses and choose a plan that minimizes out-of-pocket costs.

Consider the Costs Beyond Premiums

While the monthly premium is important, it’s not the only cost to consider. Deductibles, copayments, coinsurance, and out-of-pocket maximums are equally important when evaluating plans.

A plan with a low premium might have a high deductible, meaning you’ll pay more upfront before your insurance kicks in. Conversely, a higher premium plan may have lower out-of-pocket costs when you seek care.

For instance, if you need frequent doctor visits, a lower deductible could save you money in the long run. But if you rarely need medical care, a higher deductible plan with a lower monthly cost might be the better option. Balance both your health needs and budget to find the right fit.

Understand the Types of Plans

There are several types of health insurance plans available, and each works differently.

- Health Maintenance Organization (HMO): This plan typically requires you to select a primary care doctor. You’ll need referrals to see specialists, and coverage is limited to a network of doctors. HMO plans often have lower costs but less flexibility.

- Preferred Provider Organization (PPO): PPO plans give you the freedom to see any doctor without needing a referral. You can see out-of-network doctors, but staying in-network saves you more money.

- Exclusive Provider Organization (EPO): EPO plans don’t require referrals, but you must stay within the plan’s network. They offer a middle ground between HMO and PPO plans.

- High Deductible Health Plans (HDHP): These plans come with lower premiums but higher deductibles. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save money tax-free for medical expenses.

Understanding how these different plans work is crucial in making the right decision for your unique situation.

Check Prescription Drug Coverage

If you rely on prescription medications, make sure your plan covers them. Each insurance plan has a list of drugs they cover, known as a formulary. Check if your regular prescriptions are included on this list and understand the cost-sharing requirements for each medication.

Verify Doctor and Hospital Networks

If you have a preferred doctor or medical provider, check whether they are in-network under your plan. Visiting an out-of-network provider can lead to much higher costs. Most insurance companies allow you to search for in-network providers online, making it easy to confirm whether your doctor is covered.

Marketplace Health Insurance

For affordable coverage, many people look to Marketplace health insurance 2025 plans, which are available through government-run exchanges. The Marketplace offers a variety of plans, often at lower costs thanks to subsidies for those who qualify based on income. These subsidies help make premiums and out-of-pocket expenses more manageable for many families.

The Marketplace also offers different levels of plans, from Bronze (low premium, high deductible) to Platinum (high premium, low deductible). This gives you the flexibility to choose a plan that fits your financial and health needs.

Consider Extra Benefits

In addition to basic coverage, many plans offer extra benefits like mental health services, wellness programs, and preventive care. Some may even include dental or vision coverage. While these may not be the primary reason to choose a plan, they can add value, especially if you need these services.

Read Also: Unveiling the Top Health Benefits of Abdominoplasty in Brisbane

Compare and Review Your Options

Once you have an idea of your health needs, compare different plans carefully. Look at both the premiums and the out-of-pocket costs. Consider how often you’ll need medical services and whether you’ll want the flexibility of choosing any doctor or specialist without referrals.

Conclusion

Choosing the right health insurance plan can feel overwhelming, but focusing on your unique health needs makes the decision easier. By considering factors like doctor visits, prescription drug coverage, network availability, and total costs, you can find a plan that fits your health and financial situation.