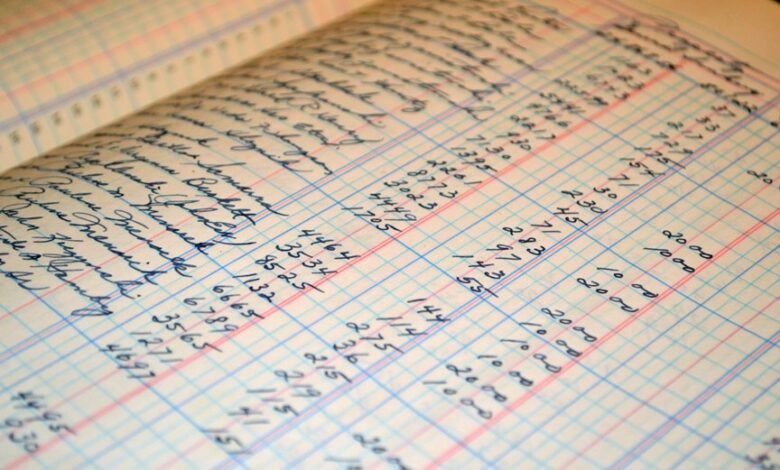

Navigating Complex Accounts With Bookkeeping 8595726165

Navigating complex accounts presents unique challenges that require a thorough grasp of advanced bookkeeping principles, as highlighted in Bookkeeping 8595726165. This resource underscores the necessity of utilizing essential tools and methodologies to enhance financial clarity and compliance. By adopting a structured approach to bookkeeping, organizations can significantly improve their operational efficiency and ensure accurate reporting. However, the journey does not end there; understanding the nuances of maintaining financial accuracy can reveal deeper insights that may redefine your organization's approach to financial management. What implications might these insights hold for your strategic objectives?

Understanding Complex Accounting

Understanding complex accounting requires a solid grasp of advanced financial principles and methodologies that underpin the discipline.

Mastery of these accounting principles is essential for navigating the intricate landscape shaped by financial regulations.

Professionals must analyze and apply these frameworks effectively to ensure compliance and accuracy, ultimately fostering a transparent financial environment conducive to informed decision-making and organizational freedom.

Essential Bookkeeping Tools

Effective bookkeeping hinges on the utilization of essential tools that streamline financial management processes.

Cloud software enables real-time collaboration and secure data storage, enhancing accessibility. Coupled with robust expense tracking systems, businesses can accurately monitor expenditures, leading to informed decision-making.

These tools not only improve efficiency but also empower users to maintain financial autonomy, ultimately fostering a more liberated approach to managing accounts.

Streamlining Your Processes

Streamlining your bookkeeping processes is essential for enhancing operational efficiency and accuracy.

Implementing process optimization techniques can significantly reduce redundancies, while workflow automation minimizes manual tasks, allowing for greater focus on strategic decision-making.

By integrating robust software solutions, businesses can achieve seamless data management, leading to improved productivity and the freedom to allocate resources toward growth-oriented initiatives.

Embrace these methodologies for transformative results.

Maintaining Financial Accuracy

Accuracy in financial reporting is paramount for any organization, as it underpins decision-making and fosters stakeholder trust.

Implementing rigorous financial reconciliation processes enhances transparency and facilitates error detection, ensuring data integrity.

By proactively identifying discrepancies and addressing them promptly, organizations can maintain accurate records that support strategic objectives and empower stakeholders with reliable information.

Ultimately, this fosters an environment conducive to informed decision-making.

Conclusion

In the intricate landscape of financial management, mastering the principles of bookkeeping serves as a compass guiding organizations through the complexities of accounting. The integration of advanced tools represents a bridge, connecting disparate financial elements into a cohesive whole. By prioritizing accuracy and efficiency, businesses not only illuminate their operational pathways but also cultivate trust among stakeholders. Ultimately, embracing these methodologies transforms financial management into a tapestry of informed decision-making, woven with threads of transparency and accountability.