Understanding Financial Records in Bookkeeping 8436281435

Understanding financial records in bookkeeping is fundamentally important for any organization aiming to achieve sound financial management and informed decision-making. The interplay between key financial statements—such as balance sheets and cash flow statements—offers a clear picture of a business's fiscal health. Moreover, the terminology and practices surrounding effective record-keeping can significantly influence operational efficiency and compliance. However, many organizations overlook subtle nuances that can impact their financial integrity. What are these nuances, and how can they be effectively navigated to ensure robust financial oversight?

Importance of Financial Records

While many businesses may overlook the significance of meticulous financial record-keeping, these records serve as the backbone of sound financial management and decision-making.

They enhance financial transparency, fostering trust among stakeholders.

Adherence to compliance regulations further underscores the importance of maintaining accurate records, ensuring that organizations not only meet legal obligations but also empower themselves with the information necessary for strategic growth and operational efficiency.

Key Financial Statements

Key financial statements are essential tools that provide a comprehensive overview of a company's financial health.

These statements include the balance sheet, income statement, and cash flow statement, each serving a distinct purpose in profit analysis.

Common Bookkeeping Terminology

A solid understanding of common bookkeeping terminology is crucial for effective financial management and record-keeping.

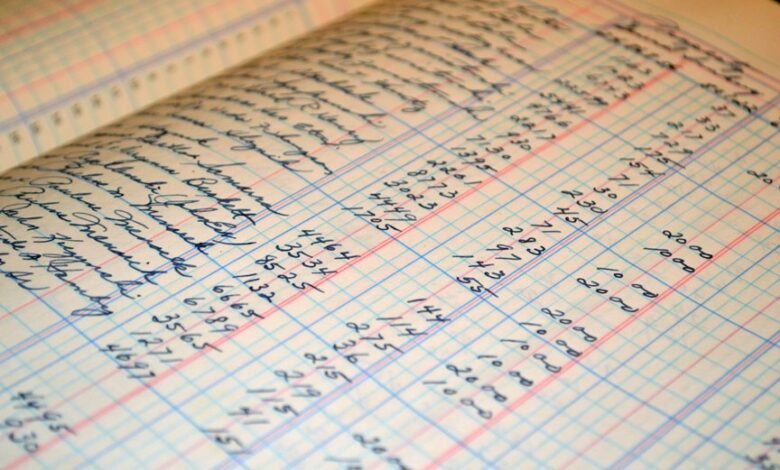

Key terms such as "accounts payable" refer to obligations a business owes to suppliers, while the "general ledger" is the comprehensive record of all financial transactions.

Mastering these terms enhances clarity in financial discussions, empowering individuals to navigate their financial landscape with confidence and autonomy.

Tips for Effective Record Keeping

How can businesses ensure their financial records remain accurate and accessible? Implementing effective organization strategies is essential.

Utilize digital tools such as cloud storage and accounting software to streamline record-keeping processes, ensuring data is easily retrievable.

Regularly audit and categorize records, maintaining a consistent filing system. These practices not only enhance accuracy but also empower businesses with greater control and insight into their financial health.

Conclusion

In conclusion, the meticulous maintenance of financial records serves as the backbone of sound financial management, illuminating the path toward informed decision-making. By mastering key financial statements and employing effective record-keeping practices, businesses can navigate the complexities of their financial landscape with confidence. Ultimately, accurate records not only foster compliance and transparency but also cultivate trust among stakeholders, ensuring that organizations are well-equipped to weather the storms of economic uncertainty.