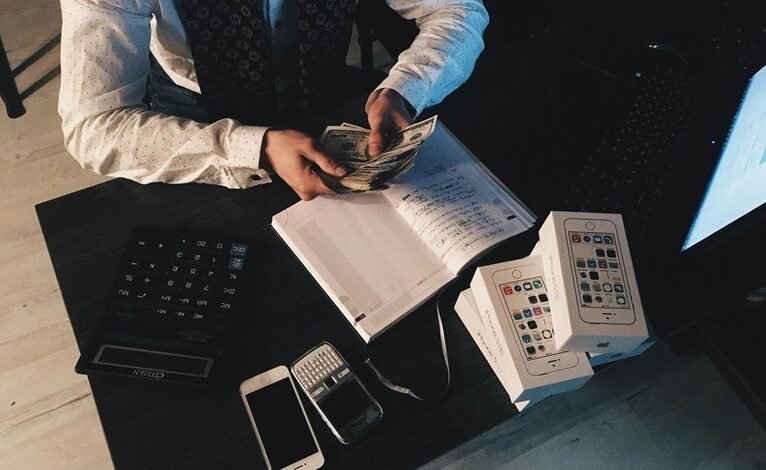

Crafting a Financial Strategy With Bookkeeping 9047301368

In today's competitive business landscape, crafting a robust financial strategy is not merely advantageous; it is essential for sustained success. Effective bookkeeping serves as the backbone of this strategy, providing the necessary insights into a company's financial health. By systematically tracking expenses and revenues, businesses can make informed decisions that influence everything from budgeting to resource allocation. However, the true power of integrating bookkeeping with financial strategy lies in its ability to anticipate challenges and uncover opportunities. What specific techniques can businesses employ to optimize this synergy for enhanced growth?

Importance of Financial Strategy

While many businesses focus on day-to-day operations, the importance of a well-defined financial strategy cannot be overstated.

Establishing clear financial goals enables organizations to align their resources effectively. Implementing robust budgeting techniques helps in tracking expenditures and forecasting future financial performance.

Role of Bookkeeping

Effective bookkeeping serves as the foundation of any sound financial strategy, providing critical insights into a company's financial health.

By ensuring record accuracy and meticulous expense tracking, businesses can identify trends, allocate resources effectively, and make informed decisions.

This structured approach not only enhances financial clarity but also empowers organizations to achieve greater autonomy and flexibility in their financial planning and execution.

Strategies for Effective Cash Flow

How can businesses ensure a consistent and healthy cash flow amidst fluctuating market conditions?

Effective cash management is crucial; implement rigorous revenue forecasting to anticipate income and expenses accurately.

Establishing a cash reserve can provide a buffer during downturns.

Additionally, optimizing accounts receivable and payable ensures timely collections and controlled outflows, fostering a stable financial environment that supports strategic growth and operational freedom.

Making Informed Financial Decisions

What strategies can businesses employ to make informed financial decisions?

Implementing robust budget planning and rigorous expense tracking is essential.

By analyzing historical data and forecasting future trends, companies can allocate resources effectively, minimize waste, and enhance profitability.

This structured approach empowers decision-makers to prioritize investments, optimize cash flow, and ultimately achieve greater financial freedom while maintaining operational efficiency.

Conclusion

In the intricate dance of business, where financial survival often masquerades as prosperity, the irony lies in neglecting the very foundation of success—bookkeeping. A robust financial strategy devoid of meticulous record-keeping resembles a ship sailing without a compass, lost in turbulent waters. Thus, the pivotal role of accurate bookkeeping emerges, transforming chaotic numbers into navigable insights. Ultimately, the commitment to diligent financial practices not only illuminates the path to growth but also ensures that the journey is not merely an illusion.